SMM Alumina Morning Comment on May 6

Futures Market: On the last trading day before the holiday, the most-traded alumina 2509 futures contract opened at RMB 2,715/mt, with a high of RMB 2,741/mt, a low of RMB 2,709/mt, and closed at RMB 2,729/mt, down RMB 3/mt or 0.10%. Open interest stood at 262,000 lots.

Ore: As of April 30, the SMM Import Bauxite Index was reported at $78.56/mt, down $1.12/mt from the previous trading day. The SMM Guinea Bauxite CIF average price was reported at $77/mt, down $1/mt from the previous trading day. The SMM Australia Low-Temperature Bauxite CIF average price was reported at $80/mt, unchanged from the previous trading day. The SMM Australia High-Temperature Bauxite CIF average price was reported at $72/mt, unchanged from the previous trading day.

Industry Updates:

- Overseas Alumina Transactions: On April 30, 30,000 mt of alumina was traded overseas at a transaction price of $348/mt FOB Western Australia, with a shipment scheduled for late May.

- Weekly Alumina Production Dynamics: According to SMM data, as of Thursday this week, the total installed capacity of metallurgical-grade alumina in China was 109.22 million mt/year, with a total operating capacity of 87.1 million mt/year, up 3.48 million mt/year WoW. This was mainly due to the commissioning and ramp-up of some new capacities, coupled with the completion of maintenance at some alumina refineries and the resumption of production. The national weekly alumina operating rate increased by 2.05 percentage points WoW to 79.75%.

- Bauxite Port Inventories: According to SMM statistics on April 30, the total bauxite inventories at nine domestic ports were 20.19 million mt, up 2.06 million mt from the previous week.

- Alumina Port Inventories: According to SMM statistics on April 30, the total alumina inventories at domestic ports were 19,000 mt, down 36,000 mt from the previous week.

- Press Metal recently announced a strategic cooperation with three local enterprises in Indonesia to jointly build a modern alumina refinery in West Kalimantan, Indonesia. The first phase of the project is planned to have an annual capacity of 1-1.2 million mt, with plans to double the capacity in the future, aiming to become a core player in the upstream of the Southeast Asian aluminum industry chain. Press Metal invested MYR 1.04 billion (approximately RMB 1.56 billion) to acquire an 80% stake in the joint venture company PT Kalimantan Alumina Nusantara (KAN) in seven phases. PT Alakasa Alumina Refinery (AAR) and PT Dinamika Sejahtera Mandiri (DSM) hold 19.77% and 0.23% stakes, respectively.

- According to Indonesian media reports, Mind ID stated that the first phase of the 1 million mt alumina project at the SGAR alumina refinery in Indonesia has been fully commissioned in Q1 2025. Currently, the second phase of the 1 million mt alumina project at the SGAR alumina refinery has been initiated. Irhamsyah Mahendra, CEO of the alumina plant, revealed that the first batch of alumina produced by the SGAR alumina refinery will be shipped to the Asahan aluminum smelter in Kuala Tanjung, North Sumatra, by the end of April 2025. The Asahan aluminum smelter currently has a total annual operating capacity of 275,000 mt, with all products prioritized to meet domestic demand in Indonesia.

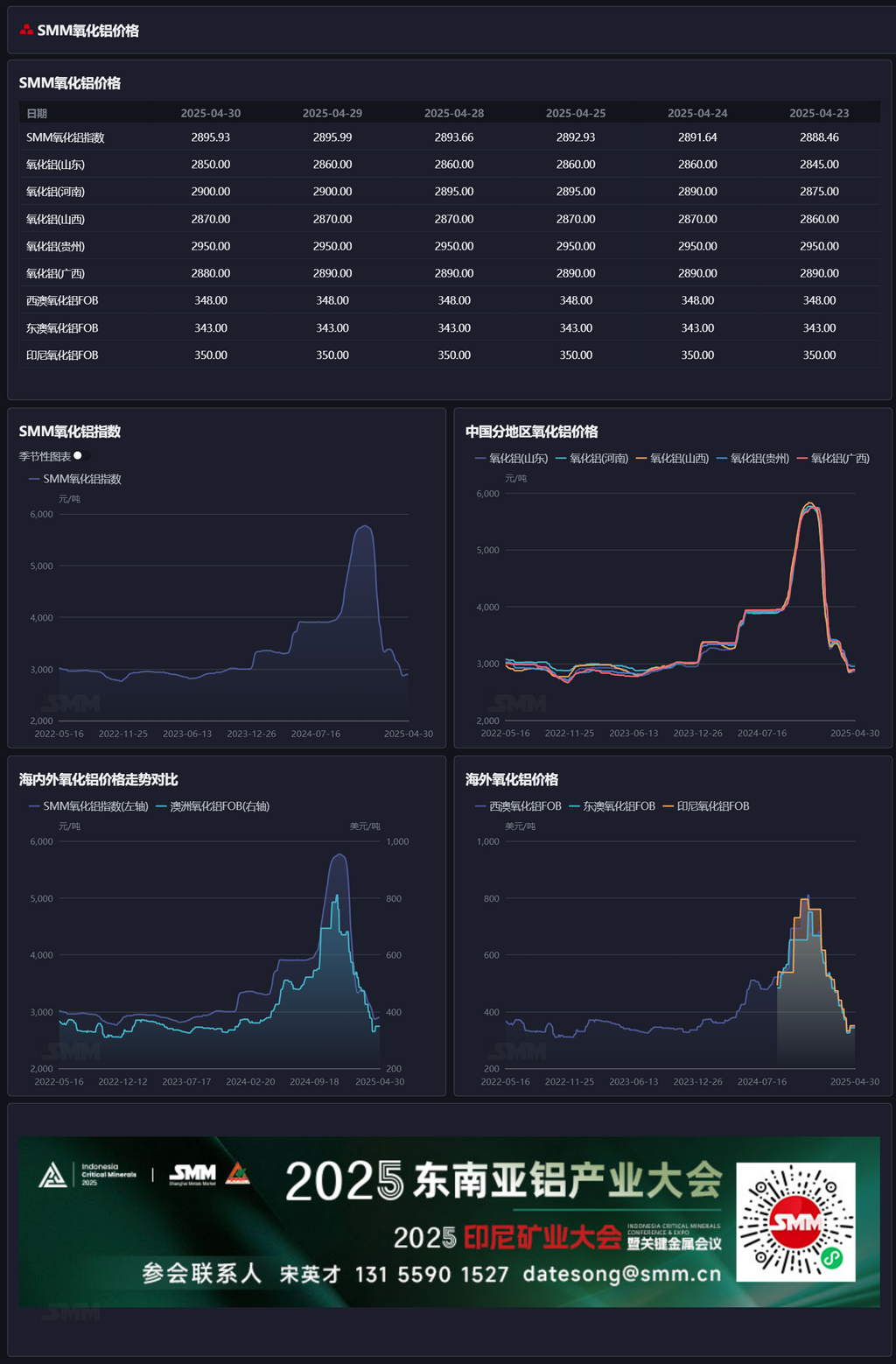

Basis Daily Report: According to SMM data, on April 30, the SMM Alumina Index had a premium of RMB 171/mt against the latest transaction price of the most-traded contract at 11:30 a.m.

Warrant Daily Report: On April 30, the total registered alumina warrants decreased by 6,317 mt from the previous trading day to 271,400 mt. In the Shandong region, the total registered alumina warrants decreased by 2,706 mt from the previous trading day to 601 mt. In the Henan region, the total registered alumina warrants remained unchanged from the previous trading day at 4,501 mt. In the Guangxi region, the total registered alumina warrants remained unchanged from the previous trading day at 36,600 mt. In the Gansu region, the total registered alumina warrants decreased by 1,506 mt from the previous trading day to 18,000 mt. In the Xinjiang region, the total registered alumina warrants decreased by 2,105 mt from the previous trading day to 211,700 mt.

Overseas Market: As of April 30, 2025, the FOB Western Australia alumina price was $348/mt, with an ocean freight rate of $20.50/mt. The USD/CNY exchange rate selling price was around 7.29. This price translates to approximately RMB 3,114/mt for the external selling price at major domestic ports, which is RMB 218/mt higher than the domestic alumina price. The alumina import window remained closed.

Summary: With the commissioning of new capacities and the resumption of production from maintenance capacities, the operating capacity of alumina has rebounded significantly, with a WoW increase of 3.48 million mt/year in the last week before the holiday. In the short term, some alumina refineries have plans for maintenance and production cuts, but at the same time, new alumina capacities will further ramp up production, and the operating capacity of alumina may show slight fluctuations. On the cost side, caustic soda prices have remained largely stable, while bauxite prices have decreased, leading to a decline in alumina costs and alleviating the loss pressure on alumina refineries. Overall, the tightening of alumina spot supply caused by the concentration of maintenance and production cuts in the early stage is expected to ease, and short-term prices are expected to fluctuate.

[The information provided is for reference only. This article does not constitute direct advice for investment research decisions. Clients should make cautious decisions and not rely solely on this information. Any decisions made by clients are independent of SMM.]